There are two long awaited IPOs after LinkedIn’s: Groupon’s and Facebook’s. We know that the latter is somewhere in the distant future, but for Groupon, its IPO will be in a matter of months, if not weeks.

But how much is Groupon worth in real life? I’m not talking about buying the rumor and selling the news. I’m talking about facts. Anyone over the age of 18 will tell you that any company is worth something if one of the following is true:

– It is profitable

– It is making money, but not yet profitable. But it will be profitable in the near future.

– It is not making money, but will make money in the near future, and will be profitable in the medium to distant future.

If anyone knows of another scenario by which a company is worth something, then by all means, share!

Looking at the list above, where do you think Groupon falls? Obviosuly nowhere. Here are some facts:

– Groupon is not profitable – in fact, it lost $540 million in user acquisition and other operational costs since its inception in 2008.

– Groupon is making money, and is not yet profitable, but will it be profitable in the future? I don’t think there’s even the slightest chance. There are some heavyweight companies seeing a lot of value in the coupon business (I think this is any oxymoron by the way, “value in the coupon business?”), these companies include Google and Facebook. Not only that, Groupon has spawned a myriad of smaller clones (some say more than 400), a dozen of them are serious about the business (they spend a lot of money in user acquisition), such as LivingSocial, DealFind, etc… It’s amazing, I never ever thought that the coupon business is that lucrative, even when offering one coupon/day, which may or may not be something people want.

Anyway, I don’t want to discuss the business model, all I want to know if Groupon is actually worth something when it becomes public. Let’s examine more facts:

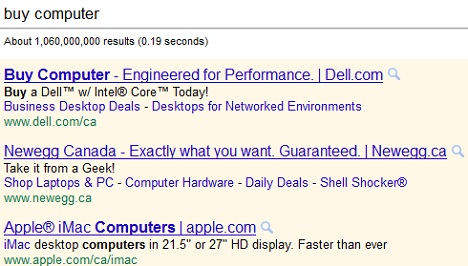

– Customer acquisition costs are increasing: Groupon knows about this and says that once a customer is acquired, it no longer needs to spend money on that customer, and that customer will be a “cash cow” for the rest of his miserable1 life. This may be true if you overlook an important factor in any business: competition. I remember that the same month I knew that Groupon existed, and that was less than a year ago, I started seeing ads for LivingSocial, and afterwards, I started seeing local ads for other coupon websites (that seemed to be available only in my area). The problem with Groupon is that the website can easily be cloned, and it was, hundreds of times! It’s only one pie, that used to belong exclusively to Groupon, but now you have many other websites that want a share of that pie too! But why are customer acquisition costs increasing? If you have ever used Google Adwords (Groupon’s main advertising platform), you will know that when you advertise for something, your cost per click is based on how much money other people are willing to pay to get that same click. In other words, when more people are advertising for the word “coupon” or “coupon website”, then the higher the cost per click is. Just search for the word coupon on Google and see how many ads you will see.

– Groupon is not changing in this ever-changing world: When Groupon was launched, it was a fresh concept that took everyone by surprise, everyone liked its sleak (and intelligent) interface. But now when you go to the Groupon website, it’s still the same, the same concept, the same features, the same everything. Groupon is not Google (and even Google is changing by the way), so it cannot afford to remain static.

– Facebook will kill Groupon: Unfortunately for Google, Groupon, LinkedIn, and other websites, there is a company that operates from California called Facebook that has hundreds of millions of real users. People go to Facebook every day, and it won’t cost Facebook a penny to advertise its own “Deals” service to its users, and it doesn’t need to guess who they are, where they are, what their interests are, what their background is, it already knows all these things! It has a huge advantage over anyone else. Imagine what would that do to Groupon. Oh, and in case you don’t believe me, check how Facebook has already shaken management at Google.

– Money delays the catastrophe but it doesn’t avoid it: Why am I saying this? Groupon is asking for $750 million from the investors? Why? So that they can spend more money on advertising, but what will happen if all the money is spent, and the company is still not profitable. That’s a very likely scenario, in fact, that is the only scenario.

– The coupon market will soon be saturated: And this is not only because of the increasing competition, but because people (yes I know it should be money) do not grow on trees. Groupon’s clickthrough rate will start going down at one point, as people who are interested in coupons will be already with Groupon (or one of its many competitors), and those who aren’t were never and will be never coupon users anyway. This reminds by the way of the stockholders’ expectations when it comes to Netflix: they think that the market is infinite even when the Netflix’s market penetration rate is already very high.

I’m sure that the most junior accountant will be able to see that the numbers won’t work. This company will never make money to cover its operating costs. Do the Groupon people know this? Unless the company is run by morons, I’m sure they do. But guess what, the real moron is the person who’s going to buy and hold that Groupon stock even for a few days after the IPO, because the money he’s going to spend will be in fact going to Groupon’s initial investors and executives, who are going to jump ship at the first opportunity. Oh, and while jumping, they’re going to yell “Suckers” at all the investors who bought this worthless, if not scammy, stock.

Yesterday LinkedIn, tomorrow Groupon, and after tomorrow Facebook2: NASDAQ crash of 2013, here we come!

1: If you’re going to spend your whole life searching for coupons, then you definitely lead a miserable life.

2: I believe that Facebook has real value, but it will be hugely overvalued by investors, who will probably pay 200% more (of the initial offering price) at IPO just to acquire the stock.