December 19, 2011 | In: Opinion

Apple: The Beginning of the End

I consider myself to be contrarian when it comes to stock trading, but I’m not contrarian just for the sake of it, I do my own research before evaluating a company, and, in most cases, my evaluation is the complete opposite of the market valuation of a company.

I do my due diligence on every company I wish to invest in, and Apple is one of them… But, while doing my own research on Apple, I have discovered that Apple’s end has already begun, here’s why:

- Apple’s creator and visionary, Steve Jobs, has passed away a couple of months ago. Not only it’s sad news for the whole word, it’s devastating news for Apple. Mind you, media everywhere has been very proactive in pointing out that Apple was doing very well during Steve’s medical leave a couple of years ago. That media campaign started even before Jobs passed away. Now, let’s look at my perspective, AAPL was literally a penny stock when Steve Jobs was outside Apple. Apple’s market capitalization back then was a mere $2 billion. Fast forward to when Jobs started re-modernizing Apple, by introducing new products that appealed to everyone (not just designers), and you can clearly see the difference. Fast forward to a few months ago, when AAPL reached an all time high of $426.70. Apple is now the #1 company when it comes to market capitalization (the stats in the linked article are slightly outdated, but it was number 2 back then). Will Apple remain the company with the largest market capitalization end of next year? Will it be able to survive without Jobs? Or will it face RIM’s fate?

-

Apple’s main products are the iPhone and the iPad, both are facing stiff competition from Android products. Samsung, Sony, and others are producing phones and tablets that are way better than Apple’s. Not only that, Android is open source, and anyone who’s anyone can develop on Android (it uses Java) and you don’t have to download iTunes or cut your SIM card in order to make your phone or tablet work (and, you’re not forced to pay by credit card to buy an Android phone or tablet). Additionally, Android has now a huge market, and there are many Android applications that are a hit, and, Samsung or Sony will not send you to jail if, God forbids, you decided to play with the insides of your phone. Now, don’t take my word of it, let’s look at Google trends of, for example, Apple’s iPad and Samsung’s Galaxy Tab:

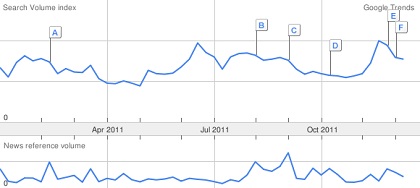

Figure 1: Apple’s iPad Trends for 2011 (Courtesy of Google trends)

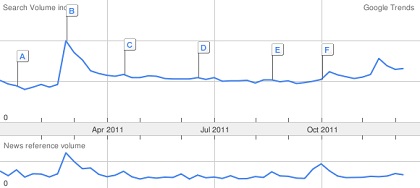

Samsung's Galaxy Pad Trends for 2011 (Courtesy of Google Trends) You can clearly see from the above that while the Galaxy is gaining steam, the iPad is losing steam. The same goes for the iPhone versus the Samsung Galaxy SII, for example (By the way, the SII is probably one of the most beautiful smartphones out there – I don’t own one myself but I saw the thing in action).

-

Apple is no longer able to meet expectations. Apple, in the Jobs era, has raised the expectations bar so high that it’s now difficult, very difficult, to meet them. People were literally expecting miracles in the iPhone 5, and because Apple knew that, they renamed the iPhone 5 to iPhone 4S (is it because Samsung has a phone called Galaxy S, I mean why the S?). I remember that I saw a video, apparently made by a fan, where he’s claiming that the iPhone 5 will feature holograms and a laser keyboard. These things are not commercialized yet, and he’s expecting them in the new iPhone 5, and most people actually believed this. Apple is no longer good at managing expectations, and that mis-management will cost it dearly by the stock market in 2012.

-

Apple will no longer have those great profit margins. Apple was first selling the iPhone for something like a $1,000. Back then I thought that whoever bought this phone at this price was insane. It’s a phone for God’s sake! You shouldn’t pay $1,000 for a phone. Not only that, you had to wait in a queue for hours and hours in the cold (or the heat) just to see if you can get one or not (let alone buying it!). So, not only Apple had great margins, it was also able to get away with treating its customers as beggars. They were able to do that because there was no competition, but now there is. The iPad will probably be priced in the $200 range next year, and the iPhone will be capped at $500.

-

Apple is no longer innovative. OK, the first version of the iPhone was innovative, when I first saw it, I said “Wow…”. The second version was just a copycat of the first version, with just some new (but hidden) features. The one after featured a better design, but nothing innovative. Nowadays, it’s the competitors that are creating Wow products. Just take a look at those new Smartphones by Samsung or by Sony Ericsson.

The market will punish Apple next year, and Apple will try make it right with the market by doing the wrong things (such as starting to copy the competitors). Apple’s peak is now, and its end is neigh. 2012 might be the last year that Apple, as we know it, exists. After that, it’ll be just another RIM or Palm. You heard it here first!

PS: Apple’s stock will be halved as soon as large investors realize they can no longer hide the truth about the imminent fall of this giant, which might be (and should be) next year!

This article (as well as all other articles on this website) is an intellectual property and copyright of Fadi El-Eter and can only appear on fadi.el-eter.com.