In this article, I will list the top 10 most hated stocks in American markets, and why they’re hated… The list is ordered alphabatecially, and not by the hate level.

1. AIG: AIG is the most treacherous stock every. You follow the trend and you buy it, and then it goes down immediately. You sell it to cut your losses, and then it goes up. If you don’t believe me, try it! This stock is programmed to not only make you lose money, but to make you feel stupid, and ultimately to hate yourself. AIG will destroy your health, your life, and your soul. A P/E ratio of 2.51 is a solid proof that there are many, many investors out there who wouldn’t touch this stock, no matter how cheap or how attractive it is.

2. AMZN: If history teaches one thing in the stock market, it’s that very rare are those companies that last for 100 years or more. Apparently the market recently noticed that Amazon was expected to last more than 100 years, and that Amazon is merely a website (we don’t know if the whole concept of a website as a business will still exist in 2112). Ever since the market realized that back in October, Amazon is in a downtrend, and it will remain so until it’s back to its normal.

3. BAC: Bank Of America is one of the most hated stock ever. Show me an investor who claims he hasn’t lost money on Bank of America and I’ll show you a liar. Everyone who’s anyone (including Warren Buffet) bought BAC shares and lost a lot of money on them. Some say that Bank of America won’t even exist in a year from now, I say I don’t care, because I know I will never ever lay my hands on this sucker anymore. Of course, you might say that volume has increased year over year on BAC but this is mainly because you can now buy almost 3 BAC shares with the same amount of money that you used to spend to buy 1 BAC share with. BAC has lost almost 60% of its value last year. This year it’ll probably lose the same (I’m sure you won’t believe me now because BAC is up 21% so far this year, but remember, this is the January Effect).

4. EK: Now a penny stock, EK has made sure that investors lose money every quarter, albeit giving them some hope for a couple of weeks every 2 months or so. The volume on this stock is less than it was a year ago, despite the fact that it is now trading at 1/7 of its price back then. This means that investors are deserting it, in masses, and those who have already deserted it have not looked back. But what’s happening to this stock anyway? Well, ask yourself, when was the last time you saw someone buying a Kodak camera? Not only Kodak is not innovative, it is also run by crazy management that is refusing to accept the fact that there is a problem in the company. Kodak’s EPS (Earnings Per Share) is -$4.59 (that’s negative $4.59 – which is almost 6 times the current stock price). Kodak may be delisted from the NYSE soon if it doesn’t go over a $1 or it may go for a reverse split (and we all know what a reverse split means).

5. GM: GM was listed on the stock market before its bailout by the US government, and it was really hated by investors then. And then, for obvious reasons, the stock got de-listed from the stock market (which was the right thing). The stock then was re-listed back in November 2010. The problem is, nothing has changed. It’s the same bad management and the same blood sucking and self-destroying union, and the same crazy strategy for selling cars for less their cost. I have warned about it even before it became public. It’s no wonder that real investors don’t touch this stock, unless they want to short it.

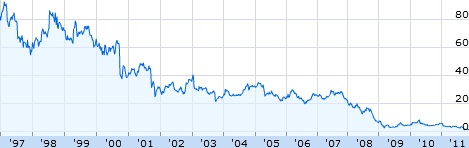

6. IRE: What do you call a stock that has to do a reverse split every once in a while in order to remain listed, and that has lost over 80% of its value in a year? I call it IRE. I think investors who are long on IRE (besides the Irish government) are dead (like literally dead, and that’s why they’re not selling), or extremely optimistic to the point of craziness. Alive and sane investors wouldn’t lay a hand on this stock, even if the PM of Ireland himself assures them that their investment will be safe, and we know how credible that assurance will be, considering the fact that the Irish government is the biggest investor in this bank.

7. LNKD: A very recent stock for a very young company (LinkedIn), LNKD quickly reduced the investors’ appetite for IPOs as it reminded them (thankfully before it’s too late) of the tech bubble 12 years ago. LNKD is a bad, bad stock. Probably the worst and the most overvalued in this list (P/E ratio is 1,200). The hate for this stock is growing every day, and it will grow even more when the stock will be worth less than a buck in a year or two. The business model that LinkedIn has just doesn’t work to payout investors. The money that the company got from the investors did not do anything to move it forward.

8. NFLX: I am quite sure that in a few years from now, Netflix will be a topic taught in marketing and investment classes at different universities on what a company should not do if it’s in the market to make money. Netflix made a fatal mistake back in 2011 when it treated its customers as cash cows, 2 times in a row. Many customers got really angry and deserted Netflix. The stock lost more than 60% of its value last year, and is set to lose more this year. Investors were literally in love with this stock, and all this love turned into hate when Netflix started doing nothing but the wrong thing to its customer base.

9. RIMM: What do you get when you have a company with no vision, that is led by the most stubborn people on planet Earth, that is losing market share every day, that is making ugly and buggy products (which are copycats of its competitors – Playbook, anyone?), that is offering a service that will become completely obsolete in a year from now (but there are still suckers using it though), that doesn’t listen to its users, and that doesn’t listen to its investors? I’ll tell you what you’ll get, you will get RIM! Canadian Research In Motion has made every step to make itself a redundant company in the technology sector by making all the wrong choices, all the time! RIMM, its stock that is listed on the NASDAQ, has lost 75% of its value in 2011, which means a loss of 1.5% every week or so! What’s not to like about this stock?

10. YOKU: This stock is not only hated, but it’s also loathed. Let’s forget about the fact that YOKU is a stock representing a Chinese website full of pirated movies. Let’s just forget about this for a second. Let’s assume that this stock is the stock of youtube.com. Now let’s go ask Google how much money it makes with YouTube, or how much money it will make in the future from the #4 website in the world. What nothing? Are you telling me that Google makes nothing on YouTube? OK, so let’s ask Google how much money it loses on YouTube? A lot? OK… So, after asking Google, we know that it loses money on YouTube, but the thing is, Google can afford it and it sees in YouTube a costly (but worthy) product for marketing and web presence expansion (or increase of web dominance). Now let’s go back to YOKU, so now we know that Youku.com can never make money, and since it’s not a part of a bigger company, then there is no reason for this website, and consequently its stock, to exist at all! YOKU is even worse than LNKD – at least LinkedIn is making money! Investors who are stuck in this stock and want to get out at the opportune moment are really miserable, because they know that this opportune moment will never come, they were suckered in and it was already too late when the discovered that! Hated stock? You bet!

Do you have any other stocks that you wish to add to this list? Please share!

This article (as well as all other articles on this website) is an intellectual property and copyright of Fadi El-Eter and can only appear on fadi.el-eter.com.