January 13, 2012 | In: Technology

Will Kodak Go Bankrupt?

After my post yesterday on Kodak’s reverse split, I made a huge research on Kodak as a company to see if it the third option in my post (Kodak to declare bankruptcy) is a possibility. To my horror, I discovered that it’s not only a possibility, it’s inevitable, and it will happen very soon. In fact, just yesterday Kodak was in talks with Citigroup about financing options for its bankruptcy. This is sad news for America, and the world as a whole. Kodak used to be one of the most respected company in the world, and its products were light years ahead of their competitors. It is thanks to Kodak that cameras and photography became mainstream, but I’m sure no one knows/remembers that anymore. It is thanks to the hard work of Kodak workers that the photography industry advanced so much in the previous decades. I’m sure no one, with the exception of its workers, will shed a tear for this company, although it deserves all the tears in the world.

Kodak reminds me of my childhood, when my mother used to take pictures of us with her Kodak camera (it was a thin, rectangular camera with a big flash) when we went for a picnic or something. I have many memories kept alive thanks to Kodak. I’m sure I’m not alone in my sentimental feelings towards Kodak, a company that signified happiness, friendship, and family bonds (Kodak moment?).

But why am I so confident that Kodak will go bankrupt? Well, there are so many reasons:

- Kodak’s EPS (Earnings Per share) is -4.59 (that’s a minus in front of the 4.59). This means that Kodak’s total losses per year are $1.2 billion, that’s 7 times its market capitalization.

-

Kodak cannot sustain the annual losses anymore. No sane bank would finance Kodak for future projects.

-

At this very second, EK is trading at almost 50 cents, down 23% from yesterday, but up 36% for the week. (this kind of fluctuation is normal with stocks that are rumored to go bankrupt).

-

Kodak is now officially talking with banks about its bankruptcy logistics.

-

Kodak has nothing, absolutely nothing, to offer for the market (when was the last time anyone felt that a Kodak product is a need rather than a want).

-

Kodak is now selling its patents (or attempting to sell its patents), as a pathetic and last resort measure to save itself.

But what happened to Kodak, a once successful and thriving business, to reach this point? Let’s see…

- Kodak’s management is the most horrible management any company can wish for. Almost all the top executives in Kodak are pre-HP workers. HP is the main competitor to Kodak in the printer area. Do I smell an inside conspiracy? Maybe. What if those executives still had some hidden ties with HP. Kodak has had problems for years now, since at least 2005. By the way, 2005 was the year that the current CEO, Antonio M. Pérez, assumed his current role – in May 2005, the month when Antonio took power, the stock dropped from $35 to $25 (almost 30%). I think that was a sign that investors didn’t want this person and didn’t like him. The only thing that this CEO did was changing the logo back in 2006 – and that was it!

-

Kodak all of a sudden stopped being innovative. Nothing new comes out of the Kodak doors anymore, and this has been the case for a long time now.

-

Kodak marketing sucks. Other than the phenomenal change that the Kodak logo experienced back in 2006, marketing has been non-existent. I was going to buy my sister a camera a couple of years ago, and I was lost between a Panasonic (Lumix) and a Kodak camera, and I eventually chose the Lumix one. The reason for my choice was that the Kodak camera came in a plastic wrapping (you know, these wrappings that are used for disposable cameras). I mean, what kind of moron would choose this packaging for a camera?

-

The company works in silos. As someone with management experience, I can tell you with confidence that silos in companies are the opposite of productivity and efficiency.

So, does Kodak have a chance? I’m afraid not – The next move will be either a reverse split (and then declaring bankruptcy) or it will be just filing for Chapter 11.

I wonder where Antonio and his cronies will go next. I just hope it’s not Apple, Google, or the likes.

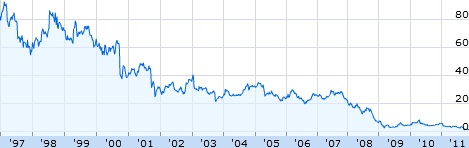

By the way, you might find the below chart (courtesy of Google Finance) interesting:

Quick update – Kodak lately did some restructuring by splitting the business into two parts:

- The consumer business: Which is the bleeding business of Kodak, and it consists of the cameras, the printers, and the likes that are sold to consumers.

- The commercial business: Which consists of products/services sold commercially, such as commercial scanners and document imaging (which generates about 25% to 30% of Kodak’s revenue). Kodak’s commercial business has been profitable for the last couple of years.

The re-structuring of the business is a normal step that companies take prior to declaring bankruptcy.

This article (as well as all other articles on this website) is an intellectual property and copyright of Fadi El-Eter and can only appear on fadi.el-eter.com.