September 14, 2011 | In: Technology

Is Amazon Overvalued?

While checking an item on Amazon (NYSE:AMZN) this morning, I thought about its stock, is it overvalued? Since Amazon is a website, it’s easy to determine whether its overvalued or not by comparing its traffic for the last 12 months to its stock price over the last month as well.

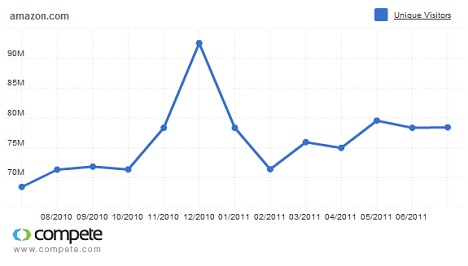

Here’s the traffic (actually I went for 13 months that’s how the traffic chart is generated by default):

Now here’s the stock price over the past 13 months (from July 2010 until July 2011):

Let’s look at the above 2 charts: You can easily see that the traffic to Amazon’s website has increased by 10 million unique visitors year over year, which is around 14%. At best, the traffic to Amazon’s website has increased by 35% in December (which is normal, Christmas season).

As for the stock, it has increased by 82% from July 2010 to July 2011, which is more than double the December spike. The stock went from $122 to $222. Hmmm…. Well, let’s give the stock the benefit of the doubt, maybe it was really undervalued before now it has reached its normal price. But the stock is now trading at a P/E ratio of almost a 100, and this is a website for God’s sake! Let’s say this again, Amazon is a website!

Is Amazon overvalued? Definitely! By how much, well, let’s just say that the stock should be trading at 1/10th of its current price, so it’s overvalued by almost 90%. But hey, how cares? Amazon is nearly identical to Netflix (a company that is worth much less than what it’s currently priced at) when it comes to being overvalued. I wonder which one will collapse first…

1 Response to Is Amazon Overvalued?

What Will Amazon Do with RIM? « Fadi El-Eter

December 30th, 2011 at 7:06 pm

[…] Even a RIM Chairman confirmed this lately, by stating that RIM spurned an offer by Amazon (an overvalued company which stock, AMZN, is worth one tenth of its current value) to buy the company. Wow! Another reason […]