January 1, 2011 | In: Opinion, Technology

An Analysis of Mobile Phone Stocks from Another Perspective

When buying stocks, I always try to separate between hype and the real stuff. I prefer to know if there’s a reason why a stock goes up or down, or if the stock’s movement is purely based on speculation (in other words, baseless). One of the most fundamental lessons I learned, is that, at one point or another, the market goes back to its senses when assessing a certain (over-penalized or over-rewarded) stock.

Lately, I have been intrigued by mobile hardware stocks, such as MOT (Android Phones), RIMM (Research in Motion’s Blackberry), and APPL (Apple iPhone). I was wondering, since all these phones are web enabled, there is definitely a better and more transparent way than sale figures to see how these stocks will perform in the future, and whether they’re currently undervalued or overvalued. Since every website records the browser and the OS of the client machine, it is easy to see assess these phones are faring against each other. For example, we can see how much percentage of a website’s traffic Android phones are generating.

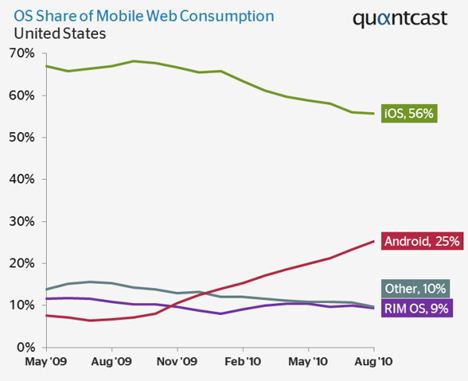

Take a look at the below breakdown of the mobile traffic to US websites (courtesy of Quantcast):

First let me say that this chart is until August 2010, and I couldn’t find a newer one, but the trend is clear. You can clearly see that Android and the iOS will intersect possibly in April of 2011, when they will both have around 45% of the market share. It’s obvious that Android has a very bullish trend, while that of the iOS is bearish. I think this makes sense: Unlike iPhone/iPod users, Android users enjoy the openness of the system, the low prices, and the innovation of competing manufactures (Motorola, Google, and Sony Ericsson) that iPhone/iPod.

Now as for the Blackberry, it’s fairly steady (and I’m inclined to say that is slowly, but surely, losing some market share). The same goes for “Other”, which mainly means Symbian phones, or in other words, Nokia Phones.

Now let’s examine the stocks one by one:

– NOK: Currently trading at $10.32, which is a fair P/E for its current and potential market share. Mind you, Nokia phones are very dominant in China and third world countries (possibly due to their very low prices). I don’t think NOK makes a good investment at the moment, unless they stop doing the wrong thing.

– MOT: Although Motorola produces Android phones, which apparently are set to overtake the web mobile market possible before the mid of next year (yes, it’s still 2010, I till have a couple of hours), it is currently trading at an insane P/E (over 112). I would not recommend this stock even to my fiercest enemies. It is too dangerous.

– RIMM: With a somewhat steady market share and a very low P/E, I think RIMM may be a good investment, but only for next year (at least for now); this stock is plagued by many issues which makes it a sort of an uncertain investment. I do think that the stock has the potential of breaking above the $80 level should RIM keeps a tight grasp on its market share locally and overseas (which is easier said than done).

– AAPL: The above graph demonstrates that the use of the iOS (iPhone or iPod) is in a steep decline, losing 2 to 3% every month (mainly to Android phones). Although AAPL is trading at a fair P/E (currently about 21) at the price of $322 a share, I find that it’s a terrible long term investment. Investors are not able to see beyond the sales. While Apple is sitting on tens of billions of cash, they refuse to buy any innovative company to diversify their portfolio. They are toying with this AppleTV since forever (guess what, there are others who are interested in the TV streaming market). Add to that, that the hype and the free PR for the iPad (which is some junk that Apple is trying to pass as something we all need) is withering (check the news reference volume).

In all fairness, I don’t see any of these stocks as an attractive investment. The ones that we should be buying are way overvalued, and the others are just not that interesting anymore.