April 19, 2012 | In: Technology

Will Yahoo Go Bankrupt?

After this month’s post on Groupon going bankrupt, one might think that I’m bashing every public online company (or is it online public company?) – but that’s not what I’m after. It’s simply that because of my other job, I have a lot of experience in this area and can assess online companies fairly accurately.

Now, let’s move to the topic of this article – Will Yahoo go bankrupt?

Let me first start by discussing Yahoo… Yahoo, as a business, never ceases to amaze me, here’s why:

– Yahoo had (when it used its own search engine) and now it has (as it’s using Bing’s search engine) a terrible search engine. It’s impossible for anyone to get what he or she wants from that search engine. Google’s search engine is light years ahead of Yahoo’s and Bing’s. From what I’ve noticed, Yahoo’s search is mainly used by 3 types of people:

- Very young people located in the US

- Non-tech savvy people located in the US

- SEO masters testing their websites on several engines

I think the reason why Yahoo is the search engine of choice for very young people is because, Yahoo, as a portal, connects to them: they have many nonsense stories every day on celebrities, and they host the answers community, where youngsters can have their homework questions answered by experienced people.

As for why non-tech savvy people go with Yahoo as a search engine, I think that’ll remain a mystery to me, but this is what I have noticed after 15 years of using the Internet.

– Yahoo has a mediocre advertiser ROI when compared to Google. Anyone who does advertising on the web can easily tell you that Google ads convert much better than Yahoo’s. And I’m not only talking on CTR, I’m also talking on real conversions (e.g. sales). Not only that, Yahoo, has a weird way of billing advertisers, and now it’s even more complicated as you have to buy the advertising from Bing if you want to advertise on Yahoo. Maybe I’m not a marketing genius, but probably the most basic rule when it comes to selling anything is to never make the buying process complicated, and that’s exactly what Yahoo is doing.

– Yahoo is not innovative at all. In fact, Yahoo stopped being innovative the moment the website was made live. When was the last time you heard that Yahoo is trying a new endeavor? When was the last time you heard that Yahoo is releasing a new smartphone, a new tablet, a new anything? Yahoo’s sole revenue relies on ad revenue generated from its portal.

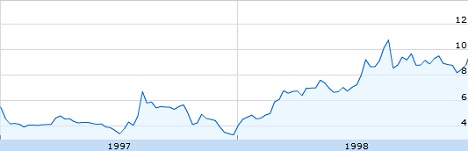

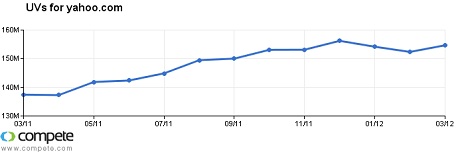

– Last but certainly not least, Yahoo posted a profit that exceeded expectations this very last quarter. Although that might seem illogical when taking the above into consideration, it seems that the spike in traffic over the last twelve months has certainly helped (I think the spike is related to the rebound in the economy). Take a look at the below:

According to the above chart, Yahoo’s traffic has increased about 12.5% over the past 12 months, which is excellent. The increase in traffic is lower than that of Google (which is 17%), but it’s still impressive. It does seem that there’s still life in Yahoo – and it does seem that Yahoo still has many cards under its sleeves.

But, let’s look at the below facts:

- Fact #1: The non-tech savvy people using the Internet are decreasing everyday, either they are becoming more savvy or they are passing away.

- Fact #2: Yahoo is leveraging its partnership with Microsoft to benefit from Facebook’s success – should that partnership end on a sour note (and it may very well do), then Yahoo’s will lose all that extra traffic coming from Facebook.

- Fact #3: Yahoo is a website, and not a website that has a lot of intelligence (as opposed to Google’s).

- Fact #4: On a scale of 0 to 10, Yahoo ranks 0 when it comes to innovation.

But, what is the answer? Will Yahoo Go Bankrupt? Obviously not, not for the foreseeable future anyway, but Yahoo has a huge chance to improve itself by doing the following:

- Making its search engine more intelligent (that will probably mean breaking up with Microsoft)

- Making the process of buying and running ads on its network much easier

- Expanding its YPN (Yahoo Publisher Network) program outside the US (currently only US residents are allowed to participate in this program)

I think Yahoo has a huge opportunity at this very moment, and it also has the momentum, why not benefit from it when it still has the chance? It’s in these times that Yahoo’s executive management can prove itself.

Yahoo will not die soon, but it will die if it doesn’t revamp itself, and doesn’t focus more on its main source of income, advertising!

This article (as well as all other articles on this website) is an intellectual property and copyright of Fadi El-Eter and can only appear on fadi.el-eter.com.