August 10, 2012 | In: Consumer - Non Cyclical

Is Colgate-Palmolive (NYSE:CL) a Good Stock to Buy?

I bought yesterday some hand soap – I usually buy them in bulk, and they last for a year or so. I buy a brand called Softsoap (it’s very prominent here in Canada) as they have a huge variety of hand soaps – some have unbelievable scents!

I bought about 12 of the “Black Orchid” scented Softsoap. For those who don’t know, these hand soaps have a unique scent that are so beautiful you’ll never want to wash with anything else. The 12 of them were only for $20. So, when I was relaxing at home, I took one of these bottles, and I read the information on the back. It was made by Colgate-Palmolive and it was made in the US. Interesting!

I then thought about all the Colgate-Palmolive brands I have used, they are many, and they include shampoos, razor blades, hand soaps, toothpastes, toothbrushes, detergents, body wash, deodorants, etc… Literally all of their products are the best, and I use them all! Not only that, all of their products are affordable, and they’re not made in China!

Did you read that? They’re not made in China! Yet they are very cheap and they are of the highest quality (I can’t think of a better quality than Colgate-Palmolive when it comes to my daily hygiene). What’s interesting about Colgate-Palmolive is that not only they do not sell us Chinese products – but they sell us home made products. For example, if you’re in France, you’ll most likely buy a Colgate-Palmolive product made in France. If you’re in the US, you’re most likely to buy a Colgate-Palmolive product made in the US or Canada. Colgate-Palmolive has always a plant near you, which is the best thing that an international company can do – since this will create jobs elsewhere (making the company look not greedy) and reduce inflation effects on the company should inflation goes significantly up in one of the countries (China is a great example).

Colgate-Palmolive is an ethical company (I think it’s one of the most ethical companies out there) with solid financial sheet, and an infrastructure that can weather the effects of any financial crisis in any country (they have plants everywhere, they have jobs everywhere, and they sell high quality non-cyclical products that all people need on a daily basis).

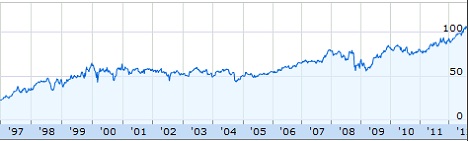

Now, let’s examine CL’s stock:

Look at the image above, do you see the trend? That stock seems to go up no matter what! It has more than tripled since 1997 – and while that not might not be an achievement when comparing it to some other companies such as Apple, it is still impressive – even more impressive when you know for sure that this company, unlike Apple, is going to be here a 100 years from now. (I’m not saying that Apple is going to disappear for sure, but I’m just saying that the possibility for Apple vanishing in a hundred years is very high since Apple is an electronics producer).

Before giving my opinion on whether Colgate-Palmolive is a good stock buy or not, let me list these facts:

- Colgate-Palmolive does not sell us Chinese products – it sells us products that are made somewhere close to us.

-

All Colgate-Palmolive products are excellent and they sell very well.

-

The Colgate-Palmolive brand means quality – lots of quality.

-

Colgate-Palmolive is trading at a P/E of 20 years – while we know for sure that this company is staying for the next 100 years or so.

-

CL’s average volume has been consistent for the last few years – although it has slightly contracted to about 10 million shares per day in 2012 from an average of about 12 millions shares per day in 2011 – but that’s not really important.

-

Colgate-Palmolive, as a company, is valued at about $54.20 billion, nearly 9% above the market value of $49.76 billion.

-

Colgate-Palmolive pays decent dividends every quarter – totaling about 2.5% of the value of the stock every year!

As you can see from above, Colgate-Palmolive is a solid company that is here to stay, with a consistent stock and it has paid decent dividends every quarter for the past 25 years (since 1987). It has only missed one quarter, which was back in April of 2006. Colgate-Palmolive is a good – very good stock. What are you waiting for?

This article (as well as all other articles on this website) is an intellectual property and copyright of Fadi El-Eter and can only appear on fadi.el-eter.com.